If you recently attended webinar you loved, find it here and share the link with your colleagues. Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers. World-class support so you can focus on what matters most.BlackLine provides global product support across geographies, languages, and time zones, 24 hours a day, 7 days a week, 365 days a year. We are here for you with industry-leading support whenever and wherever you need it.

This intersection between CFO and CIO priorities is driving more unity in terms of strategy and execution. Finance and accounting expertise is not only needed to prevent ERP transformation failures, but F&A leaders are poised to help drive project plans and outcomes. Centralize, streamline, and automate end-to-end intercompany operations with global billing, payment, and automated reconciliation capabilities that provide speed and accuracy. Ignite staff efficiency and advance your business to more profitable growth. Accelerate dispute resolution with automated workflows and maintain customer relationships with operational reporting. Unlock full control and visibility of disputes and provide better insight into how they impact KPIs, such as DSO and aged debt provisions.

To respond and lead amid supply chain challenges demands on accounting teams in manufacturing companies are higher than ever. Guide your business with agility by standardizing processes, automating routine work, and increasing visibility. BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence. Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Centralize, streamline, and automate intercompany reconciliations and dispute management.Seamlessly integrate with all intercompany systems and data sources.

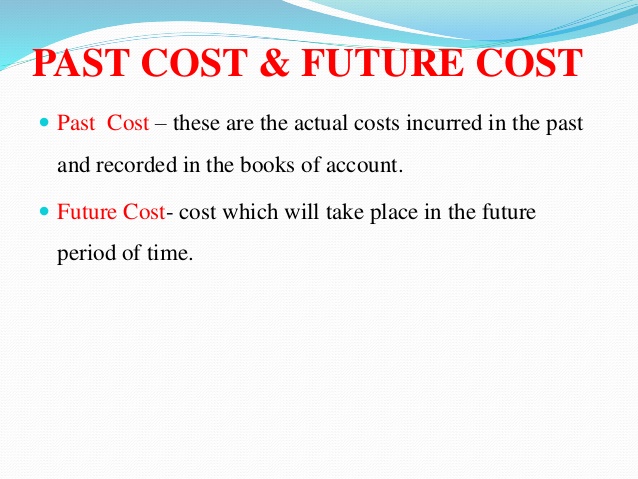

Journal Entry for Replacing Assets

This decrease in value is matched with an increase in accumulated depreciation, which provides a more accurate valuation of assets on the balance sheet. When recording this expense, we use another account called accumulated depreciation. The accumulated depreciation is a contra account of fixed assets and the balance is carried forward throughout the life expectancy. The accumulated depreciation is deducted from the cost of the assets to find the net book value of the fixed assets.

For example, a temporary staffing agency purchased $3,000 worth of furniture. When the furniture arrives, the accountant debits the fixed assets account and credits the cash account to pay for the furniture. By recording depreciation accurately, businesses can provide stakeholders with accurate information about the value of their assets. This information is important for investors, creditors, and other stakeholders to make informed decisions about the business. Accurate financial statements also help businesses to comply with tax regulations and avoid penalties.

Double declining depreciation

Accumulated Depreciation is a contra asset account whose credit balance will get larger every year. However, its credit balance cannot exceed the cost of the asset being depreciated. Outside of the accounting world, depreciation means the decline in value of an item after purchase.

- Depreciation expense is recorded on the income statement as an expense and represents how much of an asset’s value has been used up for that year.

- These include purchasing construction materials, wages for workers, engineering, etc.

- For example, it assumes that the asset depreciates at a constant rate over its useful life, which may not always be the case.

- The book value is the cost of the asset minus the accumulated depreciation.

- The net book value of an asset is determined by taking the sum of the fixed asset account – which has a debit balance – and the accumulated depreciation account – which has a credit balance.

Deosai depreciates the equipment on straight-line basis using depreciation rate of 20%. If your insurance does not reimburse the loss, enter the dollar amount of the damage, and reduce or write off the asset. Depreciation stops when the accumulated depreciation reaches the amount of the depreciable base.

The simplest way to calculate this expense is to use the straight-line method. The formula for this is (cost of asset minus salvage value) divided by useful life. Finally, accountants will determine the residual value or salvage value of the asset, which is what the asset will likely sell for at the end of its useful life. Most businesses follow a method of accounting known as the Generally Accepted Accounting Principles (GAAP). Neither short-term nor intangible assets lose their value over time, so the process of depreciation does not apply to them. Intangible assets, such as a brand or a customer database, are items that give the business value, but are also not considered physical or fixed.

Depreciation Journal Entry Example

Since the oven had no salvage value, the depreciation expense for the year is simply $10,000 divided by 10 years or $1,000 per year. Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. Keep in mind that equipment and property aren’t the only types of physical (i.e., tangible) assets that you have. Unlike equipment, inventory is a current asset you expect to convert to cash or use within a year.

Additionally, the book value may be difficult to determine accurately, which can affect the accuracy of the depreciation calculation. To record a depreciation journal entry, businesses need to calculate the depreciation expense for the asset. Once the annual depreciation expense has been calculated, they can proceed to record the journal entry. Because the original fixed asset was recorded as a debit in the asset account, the accumulated depreciation will be recorded as a credit. The fixed asset and the accumulated depreciation will show up in the business’s balance sheet. The depreciation expense appears on the income statement like any other expense.

What are the 4 types of journal entries for depreciation?

Any decrease in the market value of an asset cannot be regarded as depreciation. The cost of these assets is allocated as an expense over the years they are used. This gradual conversion of an asset into an expense is known as depreciation.

Subsequent years’ expenses will change as the figure for the remaining lifespan changes. So, depreciation expense would decline to $5,600 in the second year (14/120) x ($50,000 – $2,000). $3,200 will be the annual depreciation expense for the life of the asset. A daily cash flow summary is useful for businesses to monitor their cash and identify any potential cash flow problems before they become critical. It can help businesses to make informed decisions about managing their cash flow, such as prioritizing payments or reducing expenses, and to take corrective action when necessary. Several factors can affect the depreciation of an asset, such as wear and tear, obsolescence, and market conditions.

Impact of a depreciation journal entry on accounting: financial statements

Accounting regulations and standards are followed to ensure the uniformity of an organization’s financial statements. These procedures include documenting financial records, calculating revenue, estimating fixed-asset valuations and complying with tax laws. Generally Accepted Accounting Procedures (GAAP) form the standard used by the United States Securities and Exchange Commission (SEC). Fixed-asset accounting records all financial activities related to fixed assets.

Explains Riley Adams, a licensed CPA in the state of Louisiana working as a senior financial analyst for Google in the San Francisco Bay Area. He writes the personal finance blog Young and the Invested, which is dedicated to helping young professionals find financial independence and explore entrepreneurship. Get exclusive insights regarding daily summaries by joining Synder webinar – register now.

Adjusting Journal Entry Definition: Purpose, Types, and Example – Investopedia

Adjusting Journal Entry Definition: Purpose, Types, and Example.

Posted: Wed, 13 Jul 2022 07:00:00 GMT [source]

This way we will always have the original cost of the asset and also the information related to total depreciation charged so far in the financial statements of the entity. The accumulated depreciation account is a contra asset account on a company’s balance sheet. It appears as a reduction from the gross amount of fixed assets reported. Accumulated depreciation specifies the total amount of an asset’s wear to date in the asset’s useful life. It is important for businesses to choose the method of depreciation that best suits their needs and to ensure that they are following the guidelines for calculating and recording depreciation expenses.

Part 2: Your Current Nest Egg

The four methods allowed by generally accepted accounting principles (GAAP) are the aforementioned straight-line, declining balance, sum-of-the-years’ digits (SYD), and units of production. If an asset is sold or disposed of, the asset’s accumulated depreciation is removed from the balance sheet. Net book value isn’t necessarily reflective of the market value of an asset. Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet. The formula for net book value is cost an asset minus accumulated depreciation. To calculate the annual depreciation expense using the SYD method, the remaining useful life of the asset is divided by the sum of the digits of the useful life.

The journal entry is used to record depreciation expenses for a particular accounting period and can be recorded manually into a ledger or in your accounting software application. A fixed-asset accountant is usually a certified public accountant (CPA) who specializes in the correct accounting of a company’s fixed assets. Fixed-asset accountants often work with other accounting roles to calculate asset depreciation.

Our consulting partners help guide large enterprise and midsize organizations undergoing digital transformation by maximizing and accelerating value from BlackLine’s solutions. Our API-first development strategy gives you the keys to integrate your finance tech stack – from one ERP to one hundred – and create seamless Journal entry for depreciation data flows in and out of BlackLine. Explore the future of accounting over a cup of coffee with our curated collection of white papers and ebooks written to help you consider how you will transform your people, process, and technology. The path from traditional to modern accounting is different for every organization.

What Is Depreciation? Definition, Types, How to Calculate – NerdWallet

What Is Depreciation? Definition, Types, How to Calculate.

Posted: Fri, 16 Jun 2023 07:00:00 GMT [source]

Simply sticking with ‘the way it’s always been done’ is a thing of the past. Improve the prioritization of customer calls, reduce days sales outstanding, and watch productivity rise with more dynamic, accurate, and smarter collection management processes. In other words, depreciation is the allocation of the cost of a fixed asset to the period over which the benefit is obtained from the use of the asset. When an asset is purchased, any expenses incurred on the purchase of the asset (except for goods) increase its cost. They are debited to the “Asset A/c” and not recognised as expenses. This method requires you to assign all depreciated assets to a specific asset category.